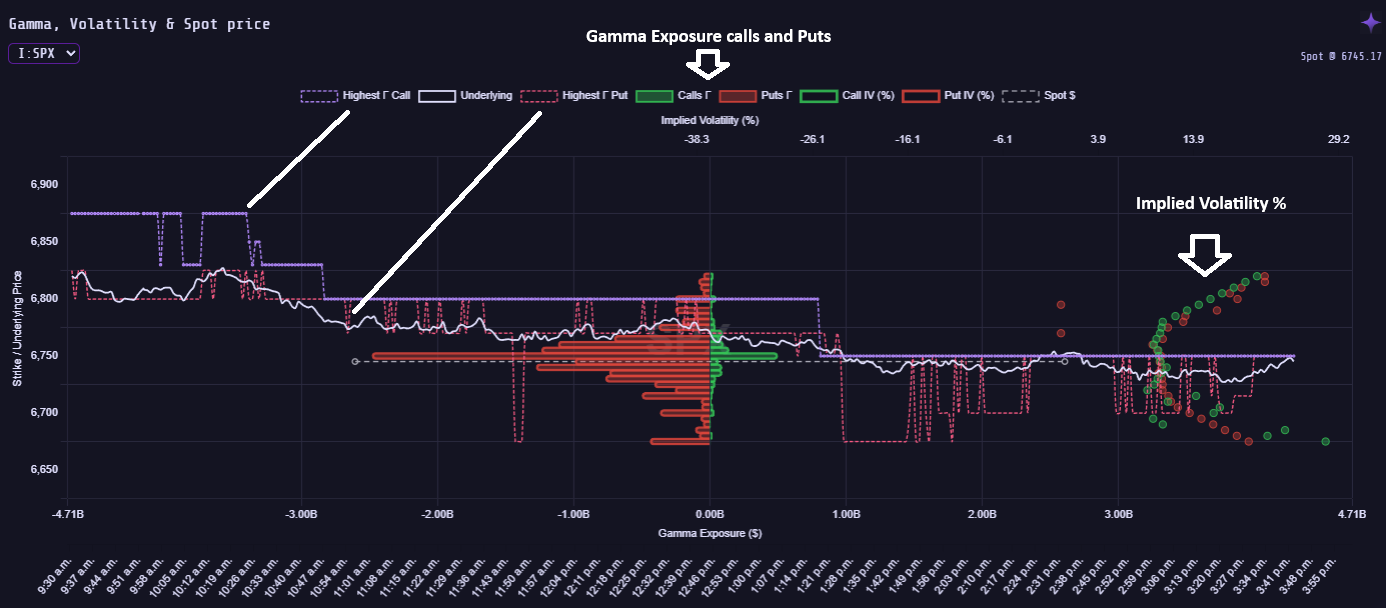

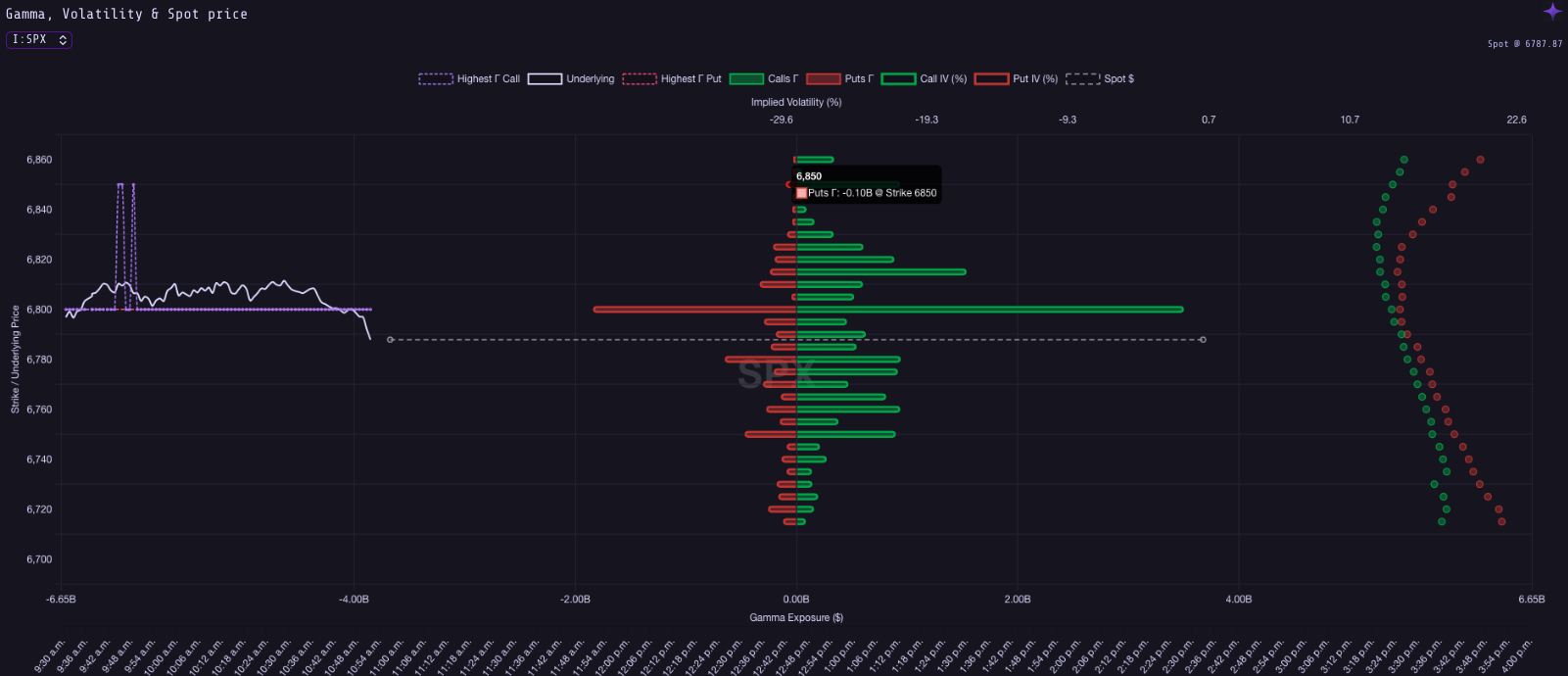

Gamma Calls, Puts, Implied Volatility & Spot Price Evolution

1. Introduction

Understanding how gamma, implied volatility (IV), and the spot price interact is key to decoding dealer hedging feedback loops.

When spot prices move, gamma changes, triggering delta hedging that feeds back into volatility — a process that can either stabilize or destabilize markets.

This triad (Gamma–IV–Spot) forms the core dynamic of modern options-driven price behavior.

2. Application

When the market moves:

- Dealers short gamma must hedge with the move — selling on declines and buying on rallies → amplifying volatility.

- Dealers long gamma hedge against the move — buying dips and selling rips → reducing volatility.

Implied volatility plays a catalytic role:

- Rising IV increases option gamma for near-the-money strikes.

- Lower IV compresses gamma sensitivity, stabilizing the market.

Spot price evolution relative to high gamma zones often indicates:

- Volatility contraction near positive gamma zones.

- Volatility expansion when crossing into negative gamma territory.

Analytical view:

- Track Net GEX vs. Spot Price across time.

- Observe how shifts in IV precede gamma transitions.

- Use combined charts (GEX + IV + Spot) to spot regime changes.

3. Key Takeaways

- Gamma dictates the directional bias of dealer hedging flows.

- IV modulates the intensity of those flows.

- Spot price movements often reflect feedback loops between dealer hedging and volatility expectations.

- Monitoring Gamma + IV + Spot together offers predictive insight into potential volatility regime shifts.