Max Pain — Call & Put Loss

1. Introduction

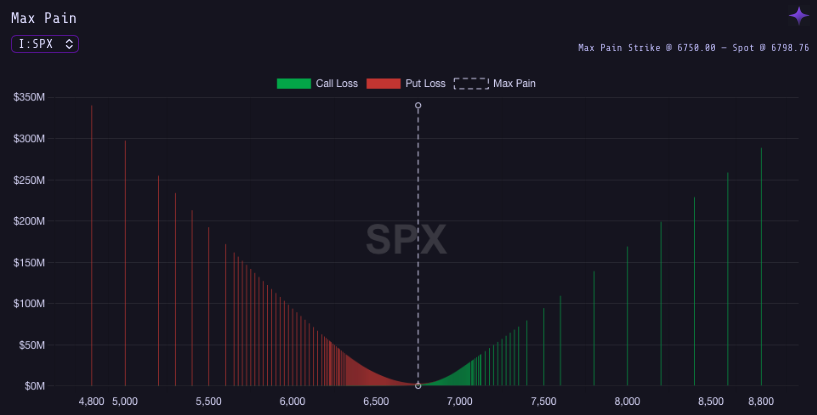

Max Pain represents the strike price where the total dollar value of outstanding call and put option losses is maximized.

It’s often referred to as the “option expiration magnet,” as the market tends to gravitate toward this price near expiration due to dealer hedging and position unwinding.

The concept comes from observing that most options expire worthless, and market makers aim to minimize their payout obligations.

2. Application

To compute Max Pain, you sum up all open interest for both calls and puts, multiplied by the theoretical loss per strike, then find the strike where total losses (for option holders) are maximized — or equivalently, where dealers’ gains are maximized.

Mathematically:

Max Pain = argmax(Σ (Call Losses + Put Losses))

Practical insights:

- When the market trades below Max Pain → more put holders are in profit.

- When the market trades above Max Pain → more call holders are in profit.

- As expiration approaches, price often moves closer to the Max Pain zone.

3. Key Takeaways

- Max Pain is a price magnet near expiration caused by option decay and dealer hedging.

- It helps traders identify potential pinning levels for the underlying asset.

- It’s not a predictive signal but an informational bias — prices may “drift” toward Max Pain if liquidity and hedging flows align.