Net Drift — Premium Calls & Puts

1. Introduction

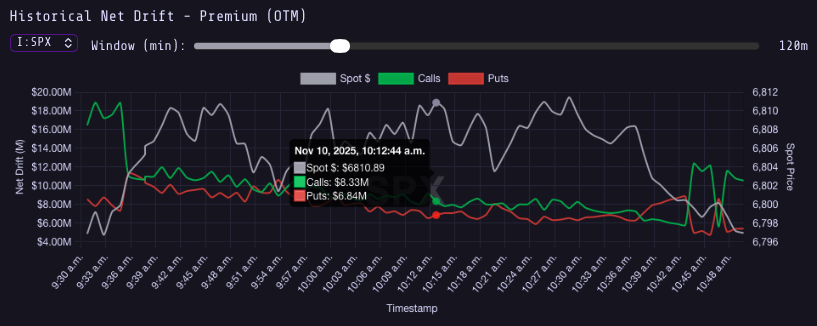

Historical Net Drift measures how option premiums evolve over time and weighted by Open Interest. By analyzing out-of-the-money (OTM) calls and puts, traders can estimate how consistently option sellers or buyers profit from premium decay or volatility events.

It’s a quantitative view of premium bias — whether the market systematically overprices risk on one side (calls or puts).

2. Application

2.1. Historical Patterns

- OTM Puts often have negative drift because volatility spikes disproportionately affect downside protection.

- OTM Calls tend to have small or neutral drift in indices due to mean-reverting markets.

- In equity indices (like SPX), long-term studies show put premiums are overpriced on average — a result of constant demand for tail-risk protection.

2.2. Strategy Implications

Understanding net drift helps design systematic strategies:

- Positive drift → Favor short volatility setups (credit spreads, iron condors).

- Negative drift → Favor long volatility setups (long puts, straddles).

- Monitoring premium decay curves around events (FOMC, CPI) helps identify temporary distortions in pricing.

3. Key Takeaways

- Historical Net Drift weighted by Open Interest shows long-term edge between buyers and sellers of volatility.

- OTM puts generally carry negative expectancy due to risk demand.

- Premium decay analysis reveals when the market overpays for protection.

- Combining Net Drift with IV improves volatility timing decisions.