Open Interest — Calls & Puts

1. Introduction

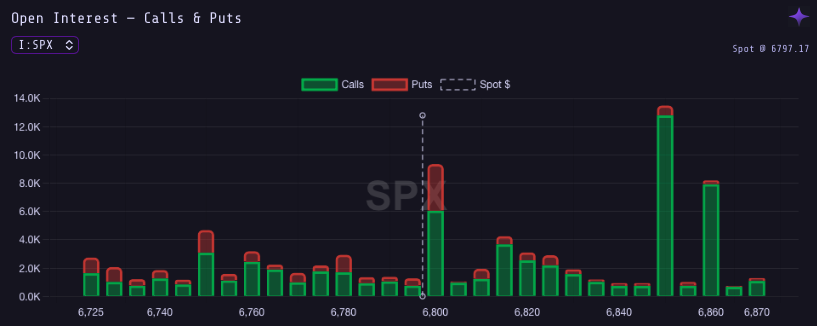

Open Interest (OI) represents the total number of outstanding option contracts that remain open and have not been exercised or closed.

Unlike volume, which measures daily activity, OI measures the size and persistence of market positions.

Tracking call and put OI across strikes gives insight into market sentiment, dealer exposure, and potential support/resistance levels created by large positions.

2. Application

2.1. Interpreting Open Interest

- Rising OI with rising price → New long positions; confirms trend strength.

- Rising OI with falling price → New short positions; bearish conviction.

- Falling OI → Position closing or profit-taking, signaling trend exhaustion.

2.2. Call vs Put OI

- High Call OI above spot → Indicates potential resistance (dealers short calls).

- High Put OI below spot → Suggests potential support (dealers short puts).

These levels often act as Gamma Walls, influencing dealer hedging and intraday movement.

2.3. OI Changes and Expirations

Monitoring daily changes in OI helps identify new exposure versus closing flows. Large OI buildup before expiration can anchor prices around key strikes, known as pinning.

3. Key Takeaways

- Open Interest shows commitment and liquidity depth.

- Combine OI with volume and GEX to interpret positioning.

- Large OI clusters mark psychological and mechanical barriers.

- Sharp OI drops post-expiry often trigger volatility resets.