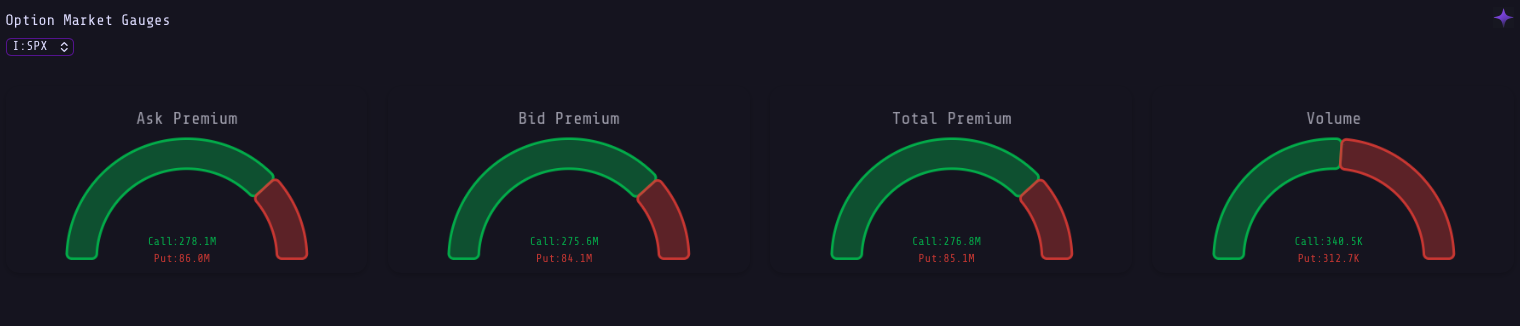

Ask Premium, Bid Premium, Total Premium, and Put/Call Ratio (Volume)

1. Introduction

Option premiums represent the price paid for the right (but not the obligation) to buy or sell the underlying.

The relationship between bid, ask, and total premium flow reflects market aggressiveness, demand, and sentiment.

The Put/Call Volume Ratio, when integrated with premium flows, adds deeper insight into risk appetite and directional bias.

2. Application

Premium Weighted by Open Interest

This metric represents the total dollar value tied to all open option positions by multiplying each strike’s premium (bid, ask, or midpoint) by its open interest and the contract multiplier. Summing across all strikes gives a single figure showing how much notional exposure the market has in the entire option chain. It is useful for identifying where capital is concentrated, measuring market positioning, and estimating the potential hedging impact from dealers.

- Bid Premiums: Indicate passive limit orders — traders waiting for favorable prices.

- Ask Premiums: Show aggressive buying — traders paying up for exposure.

- Total Premium (Midpoint) = Σ(Call Premiums + Put Premiums) across strikes.

The Put/Call Volume Ratio can be computed as:

PCR = Total Put Volume / Total Call Volume

Interpretation:

- Ratio < 1 → More call demand (bullish tone).

- Ratio > 1 → More put demand (bearish tone).

Combining volume and premium ratios provides a multi-layered sentiment model, revealing whether traders are actively buying or selling exposure.

3. Key Takeaways

- Premiums reflect real money flows — not just contract counts.

- Ask dominance = aggressiveness; bid dominance = caution.

- The Put/Call Ratio enhances classic volume ratios by capturing notional weight.

- Useful for identifying institutional sentiment shifts and volatility hedging demand.