Options Volume

1. Introduction

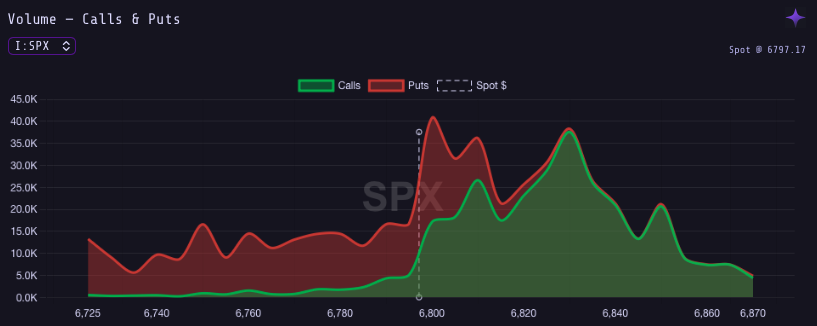

Options volume represents the number of contracts traded during a specific session.

It reflects trader activity, sentiment, and short-term liquidity in the options market.

Analyzing call and put volume helps identify whether traders are leaning bullish, bearish, or neutral.

2. Application

- High Call Volume: Indicates bullish speculation or hedging against short positions.

- High Put Volume: Suggests bearish sentiment or protection buying.

- Volume Spikes: Often precede volatility events or directional moves.

Traders often look for:

Put/Call Volume Ratio = Total Put Volume / Total Call Volume

Interpretation:

- Ratio < 1 → More call buying (bullish bias).

- Ratio > 1 → More put buying (bearish bias).

Combining volume trends with open interest shows whether new positions are being opened or closed, improving signal accuracy.

3. Key Takeaways

- Volume shows participation and conviction.

- Rising call volume = bullish tone; rising put volume = defensive tone.

- Use in combination with open interest and implied volatility for best context.